Prepare What to think about

Hall & Wilcox is committed to providing a straightforward, step by step process to achieve your succession planning goals. There are a number of points to consider in your succession planning.

Your Will is the essential part of your succession planning, as it sets out how your assets will be distributed on your death. There are a number of important parts to your Will.

Executors

Your executor is the person who administers your estate after your death.

It is usual for couples to appoint their spouse as executor, and then to appoint their children (if they are able to act), or family members or close friends to act as alternate executors.

The alternate executors would only act if the first executor cannot act or has died.

Gifts to individuals or charities

You may want to make specific gifts to family members, friends or charities. These can be set out in your Will as specific gifts.

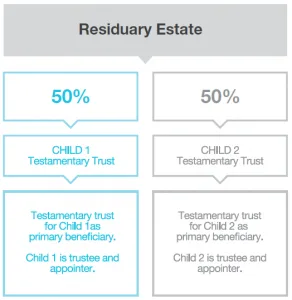

Your residuary estate

Your residuary estate is all of the assets left in your estate after paying your debts, funeral and other expenses, and any gifts.

You may consider passing your residuary estate to your spouse and then to your children or family members on the last of you to die.

Testamentary trusts

Many people use testamentary trusts to distribute their residuary estate.

A testamentary trust is similar to a family discretionary trust, however, it does not come into operation until your death.

Testamentary trusts provide many benefits including:

- asset protection from creditors (as the assets are held by the trustee for the beneficiaries of the trust)

- some protection in family law disputes (depending on the circumstances)

- taxation benefits, including the ability to make distributions to a wide range of beneficiaries (determined by the trustee) allowing for tax effective distributions and

- there are also concessions for children under 18 years, which allow around $22,801 per year (as at 1 July 2021) to be distributed to each child tax free.

Testamentary trusts can also be optional, allowing the residuary estate to pass directly to a person or through to a testamentary trust.

This gives flexibility and means the executor can decide the best course of action at the time.

The trustee of the testamentary trust decides how the trust funds are invested and distributed.

The appointor of the trust has the power to remove and appoint the trustee.

The trust can last for up to 80 years, however, it can be ‘wound up’ at an earlier time if needed.

The main beneficiary of the trust is called the ‘primary beneficiary’. The trust also has general beneficiaries.

The general beneficiaries usually include relatives of the primary beneficiary (including parents, spouses, siblings, children, grandchildren, aunts and uncles), as well as companies that the primary beneficiary has an interest in, trusts they are a beneficiary of and charities.

The trustee can distribute funds to any primary or general beneficiaries at the trustee’s discretion.

If the main beneficiary of the trust is an adult, they are often appointed as the trustee and the appointor.

If the main beneficiary is a child, or someone who needs assistance in controlling their financial circumstances due to vulnerability or disability, a relative, close family friend or trusted advisor can be appointed to act as trustee and appointor of the trust.

Default position

You may want to consider a default position to distribute your estate in the event you and your immediate family are not surviving.

This could be to your siblings, parents, charities or friends.

Guardian

If you have children under the age of 18 years, you are able to nominate a guardian to act after the death of the last parent through your Will.

Letter of wishes

A letter of wishes is a document that sits with your Will and can be used to give guidance to the executors and trustees of your Will about the distribution of your estate.

It is important to note that the letter only gives guidance, and is not binding on your executors and trustees.

You can set out your wishes regarding any family trusts, business interests, testamentary trusts established under your Will, guardians of your children, division of your personal assets, funeral arrangements and other personal matters that are important to you.

Powers of attorney

Powers of attorney and appointments of enduring guardians (depending on your State/Territory) are documents that allow you to appoint people to make financial and legal decisions, and also medical treatment decisions, if you are unable to make those decisions.

You can appoint attorneys/guardians and also alternative attorneys/guardians (who act when the attorneys/guardians cannot act).

Discretionary or family trusts

Discretionary or family trusts continue to operate despite your death.

Assets held in a trust are not distributed under your Will and remain with the trust.

You are able to deal with the succession of control of a trust as part of your succession planning.

The positions of control in a trust are:

- the trustee – who decides what investments are made and how trust funds are distributed (the trustee can be an individual or a corporate trustee)

- the appointor (or guardian) – who can appoint and remove the trustee and has ultimate control over the trust.

Documents can be prepared dealing with the succession of these positions. You can also set out your wishes regarding assets held by the trust in your letter of wishes.

This is not an exhaustive list and there may be other points that are important to your succession planning.

Hall & Wilcox provide a tailored approach for each client to ensure we take into account all of your wishes and provide succession planning solutions that achieve your goals.

To help us prepare for the meeting, please email us the following documents (where applicable to you) or if this is not possible, please bring copies to the meeting:

- Structure diagram

- Self managed superannuation fund deed

- Copies of superannuation death benefit nominations

- Family trust deeds

- Company constitutions

- Most recent financial statements for trusts/companies (including loan accounts) and self managed superannuation funds

- Life and other insurance policy statements

- Current Wills, powers of attorney and appointments of enduring guardians

- Shareholder or buy sell or other business succession agreements.

Step 1

We meet to discuss your wishes and your options

Step 2

We send you initial diagrams setting out your plan

Step 3

You review the plan, confirm any information, and return our engagement letter

Step 4

We provide you with a letter of advice and draft documents to review

Step 5

You confirm any final instructions

Step 6

We meet with you to review and sign your documents

Step 7

We provide you with copies of your documents